Hey there everybody, hope all of you guys are safe and ready to consume content that will empower you to go back of your dreams to ultimate success. After knowing all the categories of business and every requirement of it, you might end up with a question.”With Whom Should Business You Start?” “Should I start the business by myself or can I have company?” So here I am to help you analyze and understand the query and get yourself sorted.

We are The Content Bot a life passionate and ambitious team working towards empowerment and upliftment of everybody around us. When you make people around you grow, you grow automatically, that’s what we believe in. Knowledge is the only pool of resources, that grows when you share it enough. So why wait here, let’s hop on to discover and experiment with various strategies that would make sure that you grow, reach out, and make an influence in the life of people around you.

So, let’s get started.

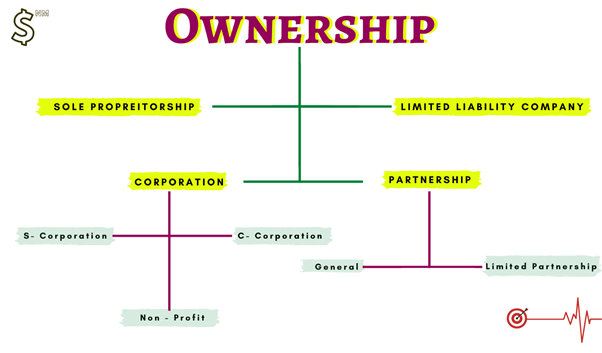

Before we move deep into the concepts, let’s have an overview of what the exact scenario is about. When we speak about business, the major point of concern is the ownership. Who runs the business? In other words, who are the leaders of it? So, when this point arises, there are multiple choices of the same. If you feel you can deal with all the business talks and the processes on your own, you can very well go for sole-proprietorship which requires and adapts with only you on the lead. If you feel like you need support, then we have alternates. So now let’s dive in to get to know about each term in elaborate.

The ownership flowchart gives you an overview of the different types of ownerships available in the place. With this overview in mind, let’s have an elaborate study on each of the elements. The four major lines of the ownership types are further classified based on the variants based on the flow process and taxation.

The major four wheels or four variants of ownership are

- Sole Proprietorship

- Partnership

- Corporation

- Limited Liability Company

Sole Proprietorship:

Sole Proprietorship is the one-man liable tax income. This is the single ownership business wherein the owner is one person and the single person is responsible for any of the processes that are happening in the business sphere. This is one of the most tangible forms of ownership as there wouldn’t be any internal conflicts that would result in the rapid loss of any of the company properties. On the other hand, there won’t be any confusion or complication for top decisions as it will be taken care of by the person on power. It is more like a monarchy system where the entire business operations are handled by a single person.

Partnership:

Partnership on the other hand is assistance or companionship when spelled right. This involves joining hands with someone else who might be your partner throughout the process of this journey of entrepreneurship. This has been successful in most of the ventures as they tend to have a partner who would support them throughout the process. But this has also been a failure in most of the times when you give equal control to someone and they tend to exploit the power and push the business towards the drain.

To make the terms and processes clear, there are two kinds of partnerships that come in to give in the exact control of power to the partner. The two streams of a partnership are,

- General Partnership

- Limited Partnership

When you take general partnership the person who is your companion has equal rights just as you. They have the same authority as you hold. The company is vulnerable to any of the decisions both persons involved take. Any mistake from either of them is enough to sue the company and bring it down. So, it is usually advised to take a lot of general steps when you mention how a partnership can bring you down.

A limited partnership is something where the power lies only with you. This kind of partnership can be used when you have the complete strength to run the company but need assistance in terms of financial needs. The partner on board with you would remain as an investment partner thereby taking care of the financial aspects of the start-up in exchange for a share in equity while having no control over the power of decisions of the company. This will make you the sole operator for all the decisions of the company.

Corporation

The corporation comes into place when the business becomes state charted. In simple words, when the business is operated by shares. At this point, the business has legal rights and the complete point of ownership flips to taking over the company after the owner’s demise. All the rights and technical ownership of the company is decided by the number of shares a person holds. This happens in a way as to when a company doesn’t have enough investment the company owner opens up the set of shares to the public’s purchase. This means that anyone can own a piece of the company by investing a sum of money into the share price. If person A has the highest number of shares then that person has the ownership of the company. So, at this point, ownership is dependent on who has the highest number of shares.

This corporation is further classified into three different variants depending on the tax benefits.

The three variants incorporation are,

- C – Corporation

- S – Corporation

- Non – Profit

C – Corporation:

In this variant, the taxes put over a person for the income obtained under holding shares falls under Income tax. So here the taxation is for the company as company tax and also for the shareholder as income tax. Any income that the person gets comes under income tax. This is because under c-corporation the person buying shares is given ownership for the particular company.

S – Corporation:

S – Corporation retains you as a shareholder thereby giving you no terms of ownership. In this element, you only remain a shareholder which makes the income non-taxable. So under this category taxation is issued only to the company. Company tax is only issued and income tax is not imposed.

Non-Profit:

This category applies to certain kinds of charitable trust and environmental safety trusts who don’t work for a profit motive and instead work for a cause. They fall under this category. The non-profit zones don’t come under taxations and so business owners who have a trust for them, utilize this permit in the most exploiting ways as to how it can be.

Limited Liability Company:

Falling in the last category, a limited liability company stands with low liability to the owners. The company owners can get debts and claim it in the business name. This way the company lies as a legal entity and gives you an enormous tax benefit. This can be claimed for both sole proprietorships as well as partner companies. When a partnership company gets them registered as LLC (Limited liability Company) then they are called LLP (Limited liability Partnership) This will give them a registered forum and gets them going with the premium tax benefits.

With all of these variants, depending on all the niche your business lies upon and with the idea of under which category the business falls upon you can choose your type of business class. Hope you liked the content and the peanut-sized information helped you gain a little attention towards the business sphere.

If you like reading it, do Like, Comment, Share Subscribe to The Content Bot Social Media & our exclusive Podcast to stay Updated!

Stay Successful & Keep Moving Digital.